Table of Contents

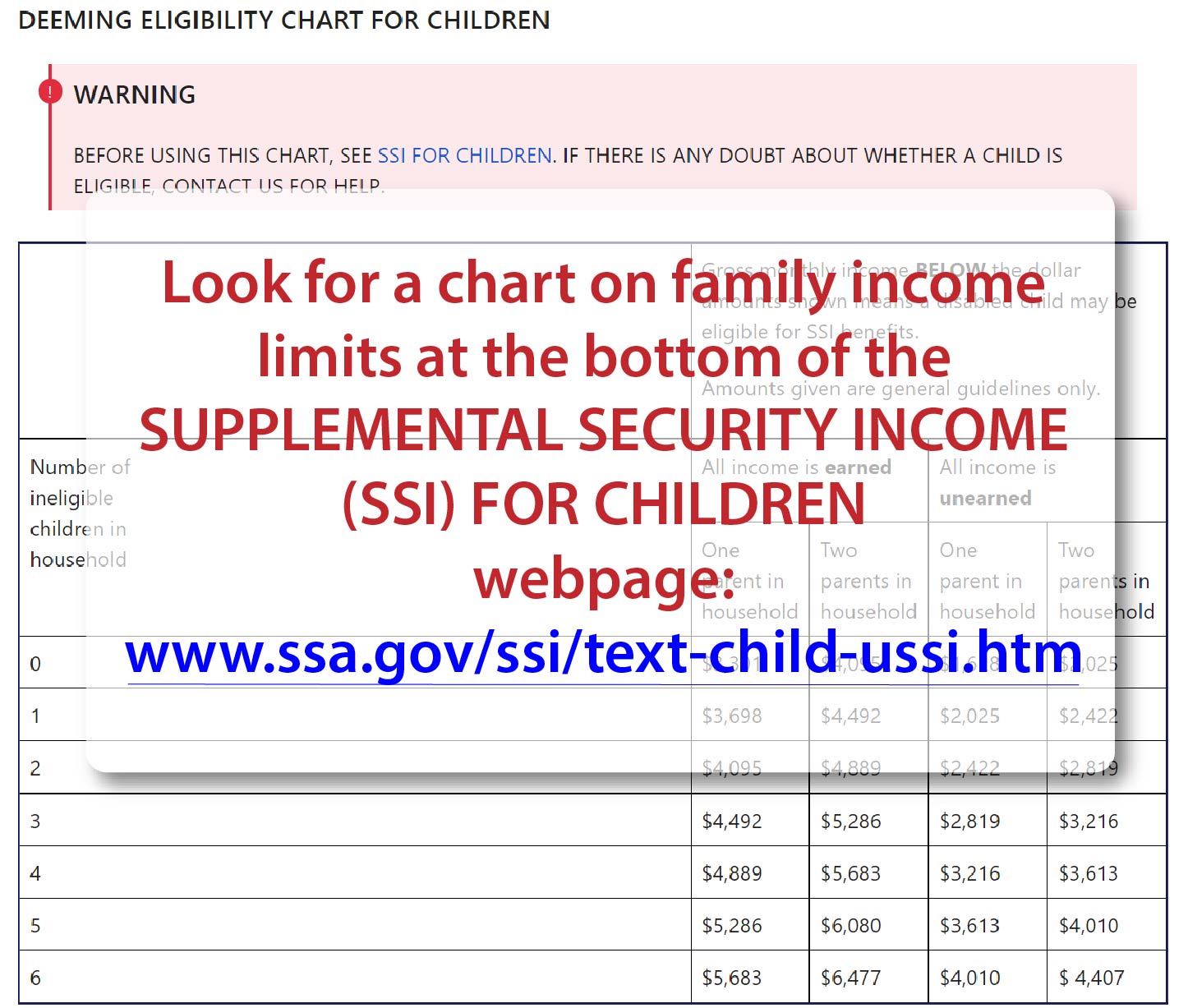

- SSI Income Limits 2024: What's the max amount you can make to apply for ...

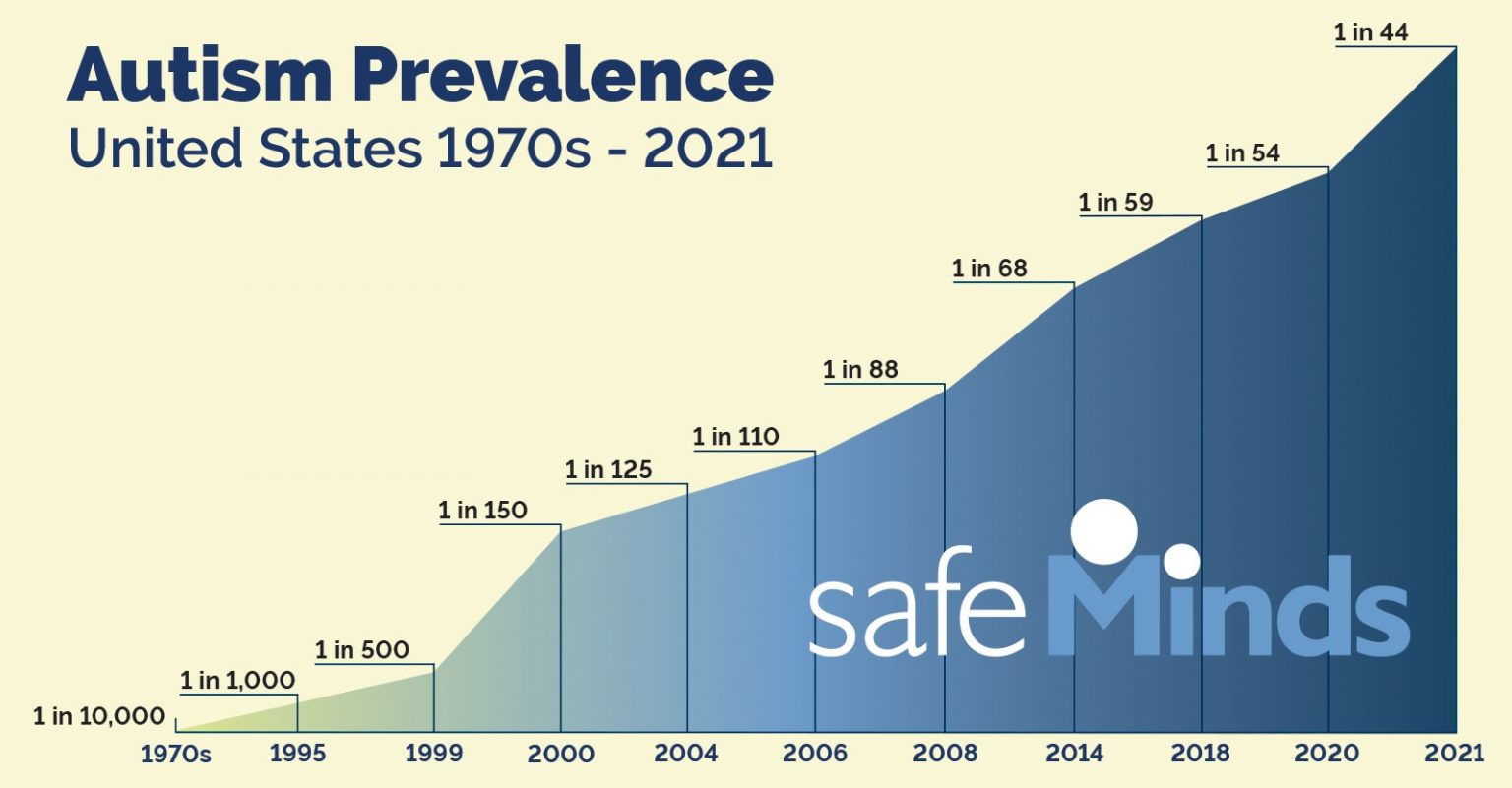

- Supplemental Security Income Increases in 2022 - SafeMinds

- 5.2% Increase to Social Security Maximum Taxable Earnings in 2024 ...

- Social Security INCREASES For 2024 (Huge Changes) | SS SSI SSDI Low ...

- CONFIRMED! Social Security BIG CHANGE in 2024 | SS SSI SSDI Low Income ...

- 0 Increase for Social Security in January 2024 – Who is Eligible for ...

- I went over on My Social Security Income Limit by 5k - YouTube

- 5.2% Increase to Social Security Maximum Taxable Earnings in 2024 ...

- Social Security COLA Increase 2025: What to Expect for Adjustment ...

- Ssi Income Limits 2024 - Gill Cathyleen

What is the Cost of Living Adjustment (COLA)?

2026 COLA: How Much Will Benefits Rise?

How Will the 2026 COLA Affect Social Security Recipients?

The 2026 COLA will have a positive impact on Social Security recipients, as it will help to offset the effects of inflation and maintain their purchasing power. For example, a retiree receiving a monthly benefit of $1,500 can expect to see an increase of around $45 to $50 per month. This may not seem like a lot, but it can make a significant difference for those living on a fixed income.

Other Factors to Consider

While the 2026 COLA is expected to be significant, there are other factors to consider when it comes to Social Security benefits. These include: Medicare premiums: Medicare Part B premiums are expected to increase in 2026, which could offset some of the gains from the COLA. Taxation of benefits: Up to 85% of Social Security benefits may be taxable, depending on income level. This means that some recipients may not see the full benefit of the COLA. Benefit caps: The SSA has a cap on the maximum amount of benefits that can be paid to an individual or couple. This cap may limit the amount of the COLA for some recipients. The 2026 Cost of Living Adjustment (COLA) is expected to bring a significant increase in Social Security benefits, with estimates suggesting a rise of around 3.2% to 3.5%. While this is good news for Social Security recipients, it's essential to consider other factors that may affect benefits, such as Medicare premiums and taxation of benefits. As the SSA officially announces the 2026 COLA, we'll have a better understanding of how much benefits will rise and what this means for those relying on Social Security.For more information on Social Security benefits and the 2026 COLA, visit the Social Security Administration website. Stay tuned for updates and expert analysis on how the 2026 COLA will impact Social Security recipients.